Trade Breakdown and Tips for Trading the British Pound

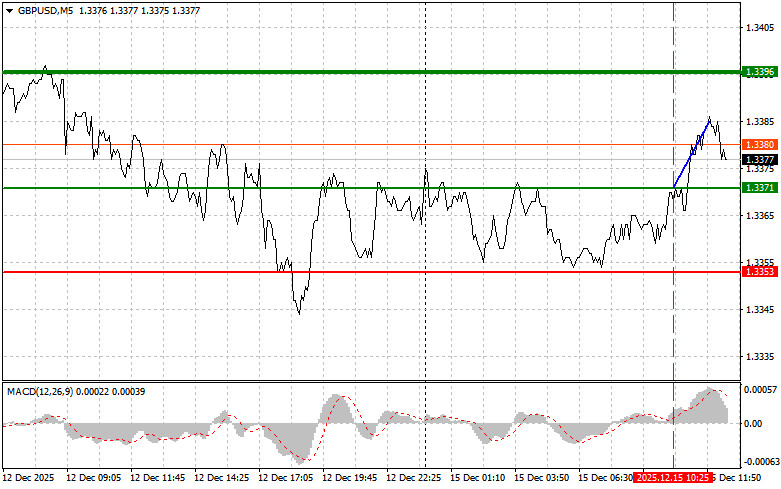

The test of the 1.3371 price level occurred at a moment when the MACD indicator was just beginning to move upward from the zero line, which confirmed a correct entry point for buying the pound. As a result, the pair rose by 15 points.

The absence of UK data supported the pound in the first half of the day. However, the euphoria was short-lived. The strengthening of the British currency encountered a number of restraining factors, including ongoing uncertainty regarding economic prospects and expectations of further steps from the Bank of England. Investors are also exercising caution while assessing the potential impact of political instability on the country's economy.

Attention then shifts to reports on the Empire Manufacturing Index and the NAHB Housing Market Index. Shortly after their release, a speech by FOMC member John Williams will take place. Weak data could trigger a new wave of growth in GBP/USD. Poor readings from the Empire Manufacturing Index and the NAHB Housing Market Index may spark concerns about a slowdown in U.S. economic growth. This, in turn, would increase pressure on the U.S. dollar and create favorable conditions for strengthening the British pound. However, it should be taken into account that the market may react differently. Strong manufacturing and housing market data, on the contrary, would strengthen the dollar and put pressure on GBP/USD. Thus, the key factor will be not only the absolute values of the published data, but also how well they match market expectations.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy Signal

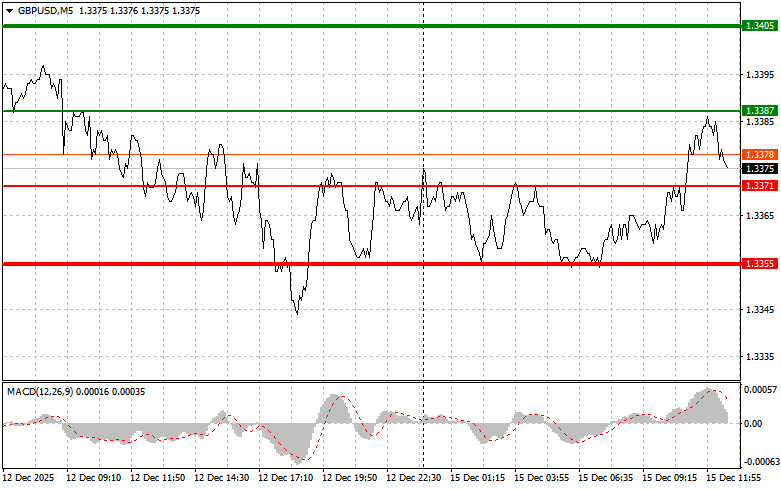

Scenario No. 1: Today, I plan to buy the pound upon reaching the entry point around 1.3387 (green line on the chart), targeting a rise to the 1.3405 level (thicker green line on the chart). Around 1.3405, I will exit long positions and open short positions in the opposite direction (targeting a move of 30–35 points in the opposite direction from the level). Growth in the pound today can be expected only in the case of a dovish stance by the Fed. Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3371 price level at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reverse upward market reversal. A rise toward the opposite levels of 1.3387 and 1.3405 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the 1.3371 level is updated (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3355 level, where I will exit short positions and also immediately open long positions in the opposite direction (targeting a move of 20–25 points in the opposite direction from the level). Pressure on the pound may return today in the case of a hawkish stance. Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3387 price level at a moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse downward market reversal. A decline toward the opposite levels of 1.3371 and 1.3355 can be expected.

What's on the Chart:

- Thin green line – the entry price at which the trading instrument can be bought;

- Thick green line – the expected price where Take Profit orders can be placed or profits can be fixed manually, as further growth above this level is unlikely;

- Thin red line – the entry price at which the trading instrument can be sold;

- Thick red line – the expected price where Take Profit orders can be placed or profits can be fixed manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner Forex traders need to be very cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.